Forget about a balloon percentage

Some unsecured loans have monthly obligations and you may a good balloon fee (read: a more impressive than simply mediocre swelling-sum commission) at the end of the brand new loan’s payment term. The balloon fee might possibly be double the since your monthly fee otherwise large.

For people who refinance yours loan, you may be in a position to get rid of the balloon percentage and you may opt to get more positive financing terms.

Refinancing your very own financing can result in your credit score to decrease somewhat to start with. Nevertheless the perception decrease when you generate monthly installments on time plus complete. As to why? As the this is the power away from to the-date money. It improve your commission record, which makes up 35% of your credit score.

Difficult credit check for the the loan

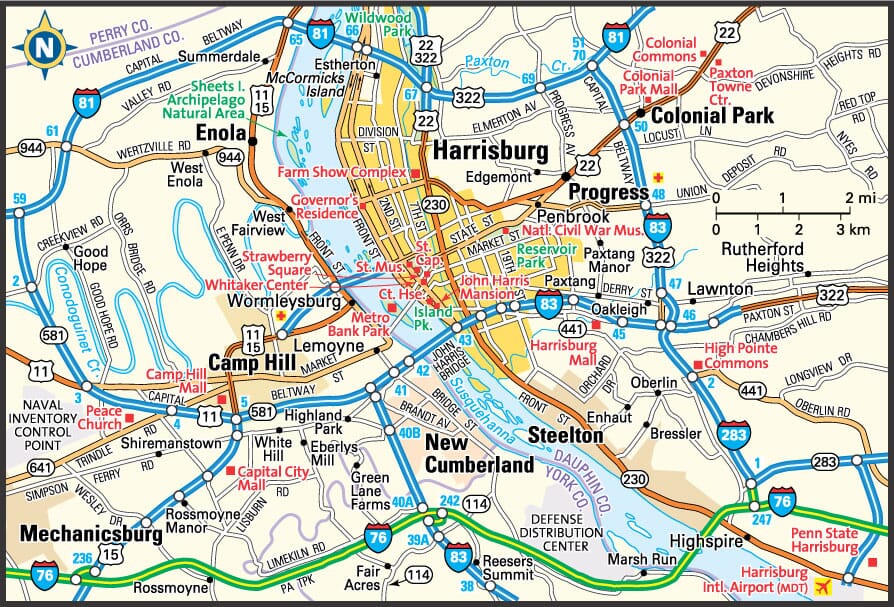

When you refinance your own personal loan, or perhaps regarding the whenever you submit an application for a unique loan or borrowing, a loan provider is going to do a challenging credit assessment (referred to as a painful borrowing from the bank pull otherwise an arduous credit inquiry). The new https://elitecashadvance.com/personal-loans-pa/lawrence/ query will cause your credit score playing hook, short-title dip.

Very, you could think about the slight, short-stayed lose on your own credit score given that a small drawback when you evaluate it on the currency refinancing could potentially save.

Closure an old account

The age of your credit history are a cause of figuring your credit rating. In the FICO credit reporting design, it accounts for fifteen% of one’s credit rating. Whether your personal loan is the credit membership you’ve had the longest, your credit score could be shortened for those who re-finance.

Beginning yet another borrowing from the bank membership

Brand new credit accounts for 10% of your FICO score. Starting an alternate account may cause your credit score to slide (temporarily). You will need to prevent starting several brand new membership immediately since the it will only proliferate the brand new affect your rating.

Do you know the Dangers and you will Benefits of Refinancing a personal loan?

When you’re determining whether to re-finance your personal mortgage, it is helpful to stage from pros and cons. We’ve got discussed the top benefits and drawbacks regarding refinancing the personal bank loan.

Gurus regarding Refinancing a personal bank loan ??

You can get a lower life expectancy Apr (a loan’s interest and charge), that reduce the quantity of focus you only pay along the life of the mortgage, helping you save currency.

Because you can use more money than your loan number, if you have enough credit debt or features various other highest-desire financing, you need to use the excess money to pay it off. You may also manage to combine the personal credit card debt by moving it to a different cards which have a low Annual percentage rate and you will purchasing it off even more quickly.

Drawbacks of Refinancing a consumer loan ??

Refinancing your personal financing will likely require an enthusiastic origination payment which is 1% 10% of the amount borrowed. This may put notably on the loan’s rates, especially if you will be credit more than you really need to refinance.

Do you know the Measures so you can Refinancing Your very own Financing?

- Gather information

Very first, have the items. Work out how much you still owe and you will what costs you would have to pay so you’re able to refinance. Opinion your credit rating so you can assess in case the borrowing from the bank enjoys improved because you grabbed from loan. And you can whether you’re refinancing along with your newest lender otherwise an alternative you to definitely, don’t forget to check if your financial tend to costs a great prepayment fee having refinancing.

- Score prequalified to own a personal loan

Pose a question to your bank so you can prequalify you for the the brand new loan. You’ll be able to see how far you can remove (especially if you should obtain more money compared to the mortgage amount) and you can exactly what the financing conditions might be.